Introduction:

For investors and traders, keeping track of earnings announcements is an essential part of the investment process. The release of corporate earnings reports provides valuable insights into the financial health of companies and can significantly impact the prices of their shares. An earnings calendar is a helpful tool for investors to keep track of these reports and to make informed investment decisions. In this article, we will provide a comprehensive guide to understanding earnings calendars, how to use them, and the key factors to consider when evaluating earnings reports.

What is an Earnings Calendar?

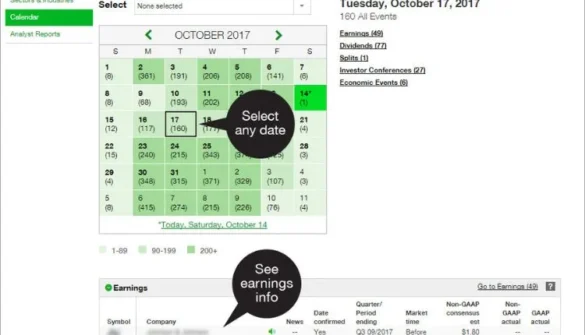

An earnings calendar is a schedule of the dates on which publicly traded companies will release their quarterly or annual financial results. These reports are typically released every three months, and the earnings calendar provides investors with a timeline of when to expect the release of these reports. The earnings calendar also includes information such as the company name, the date and time of the release, and the expected earnings per share (EPS) and revenue figures.

Why are Earnings Reports Important?

Earnings reports are crucial for investors as they provide insights into the financial performance of a company. They contain key information such as revenue, earnings, and guidance that can significantly impact the stock price. Positive earnings reports can result in a stock price increase, while negative reports can cause a decline in the stock price. Therefore, keeping track of earnings reports is crucial for making informed investment decisions.

How to Use an Earnings Calendar?

Using an earnings calendar is relatively simple. It provides a list of dates when companies are expected to release their earnings reports, which allows investors to plan their trading strategies accordingly. Investors can use the earnings calendar to track their investments and stay up-to-date with any potential changes in the market.

Key Factors to Consider When Evaluating Earnings Reports:

1. Revenue and Earnings: The revenue and earnings figures are the most crucial factors to consider when evaluating an earnings report. Investors should compare the current figures to the previous quarter or year and look for trends in the company’s financial performance.

2. EPS: Earnings per share (EPS) is the company’s net income divided by the number of outstanding shares. EPS provides an insight into the company’s profitability and can be used to compare the company’s performance to other companies in the same industry.

3. Guidance: Guidance refers to the company’s future expectations for earnings and revenue. Investors should pay close attention to guidance as it can significantly impact the stock price.

4. Market Reaction: Investors should also consider the market’s reaction to the earnings report. A positive report may result in a stock price increase, but if the market reacts negatively, the stock price may decline.

Conclusion: An earnings calendar is an essential tool for investors to stay up-to-date with earnings reports and make informed investment decisions. By understanding the key factors to consider when evaluating earnings reports, investors can make more informed decisions and stay ahead of any potential changes in the market.

FAQs:

Q1. How often are earnings reports released? Earnings reports are typically released every three months.

Q2. What is EPS? Earnings per share (EPS) is the company’s net income divided by the number of outstanding shares.

Q3. How can investors use earnings calendars to plan their trading strategies? Investors can use earnings calendars to track their investments and stay up-to-date with any potential changes in the market. They can plan their trading strategies accordingly based on the expected release dates of earnings reports