The world of financial trading can often resemble a vast ocean with waves representing the ebbs and flows of market sentiment. Surfers in this sea are the traders, looking for the perfect wave, or in the case of the financial world – chart patterns. These intricate formations that emerge on the graphs of asset prices are more than mere lines and curves; they are visual narratives of human psychology playing out in real-time. Among these narratives, trading chart patterns stand as a testament to collective behavior, offering a lens through which we can understand market dynamics.

Chart patterns provide a canvas to visualize the power of mass psychology in the markets. When a pattern emerges, it conveys not just price movements but the fears, doubts, hopes, and greed prevalent among investors. Technical analysis chart patterns become a trader’s atlas, guiding them through the landscape of market sentiment. Pattern trading harnesses these insights, presenting opportunities to forecast potential market directions.

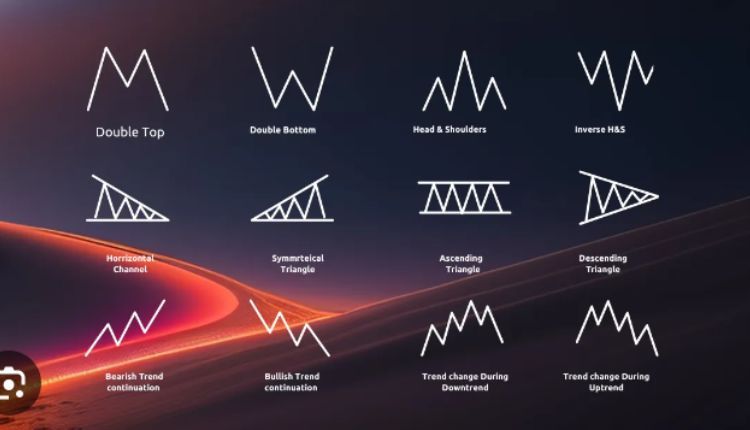

Delving into the psychology behind pattern trading reveals that human emotions often manifest in repetitive behaviors, forming recognizable patterns such as head and shoulders, triangles, flags, and double tops and bottoms. These formations can be bullish chart patterns signaling upward momentum or their bearish counterparts hinting at impending declines. The beauty lies in the trader’s ability to decipher these cues like an archaeologist interpreting ancient hieroglyphics.

When traders utilize forex chart patterns, for example, they are tapping into the global pulse of economic confidence and decision-making across nations. A single chart pattern can tell a story of shifting policies, emerging economic data, or evolving trade relationships. It is akin to playing a game of chess with the world, where every move is influenced by a complex set of underlying psychological currents.

Moreover, trading chart patterns offer a unique blend of art and science, where intuition meets empiricism. Traders become artists who read the charts with a kind of sixth sense developed through experience while grounded in the empirical data laid out before them. This artistic approach to the graphs also underscores a deep human desire to find order in chaos, to make sense of what appears random by finding patterns and trends that are otherwise hidden.

One cannot help but admire the resilience imbued within pattern trading. As bullish chart patterns reveal optimism growing like blossoms in spring, they encourage traders to anticipate and ride upward trends; each peak potentially higher than the last as confidence builds upon itself. In contrast, when the winds change and patterns tilt downwards, savvy traders interpret these signals with prudence and adapt their strategies accordingly.

In essence, chart patterns serve as an emotional barometer for the market. Trading pattern recognition thus becomes an exercise in empathy; placing oneself within the collective mindset of investors and deducing where sentiment may next lead. Accurately reading these signs can mean the difference between catching a formidable wave or missing the tide completely.

As we’ve navigated through the psychological undercurrents that chart patterns reflect, it’s clear that they embody an essential facet of trading wisdom. They are not just tools for predicting price movements, but symbols representing the heartbeat of market psychology. Embracing technical analysis chart patterns means engaging with a narrative that runs much deeper than lines on a screen – it means understanding the story of human behavior encoded within those lines.

Engaging with trading chart patterns thus requires a dual wielding of logic and intuition – a delicate balance that if struck correctly, can lead to some of the most profound insights into market dynamics. For traders around the globe, mastering this aspect of trading is not just profitable; it is intellectually fulfilling and emotionally rewarding, completing their journey from novices to seasoned market psychologists.

Chart patterns convey layers of psychological complexity within their seemingly straightforward formations and therein lies their true power – a power that engaged traders leverage to navigate through the tumultuous yet exhilarating markets day after day.